By Kate Donald, Center for Economic and Social Rights, and Jens Martens, Global Policy Forum

The 2030 Agenda cites the “enormous disparities of opportunity, wealth and power” as one of the “immense challenges” to sustainable development. [fn] UN (2015b), para. 14. [/fn] It recognizes that “sustained, inclusive and sustainable economic growth…will only be possible if wealth is shared and income inequality is addressed”. [fn] Ibid., para. 27. [/fn]

A major part of the inequality picture is increasing market concentration and the accumulation of wealth and economic power in the hands of a relatively small number of transnational corporations and ultra-rich individuals. Intense concentration of wealth and power is in fact inimical to progress across the entire 2030 Agenda.

This trend has not emerged accidentally: inequality is the result of deliberate policy choices. In many countries, fiscal and regulatory policies have not only led to the weakening of the public sector, but have also enabled the unprecedented accumulation of individual wealth and increasing market concentration.

But, there are robust and progressive alternatives to these policies, which could effectively redistribute wealth and counteract the concentration of economic power. Such alternative policies will be a prerequisite to unleash the transformative potential of the SDGs and fulfill their ambition “to realize the human rights of all” [fn] Ibid., preamble. [/fn] .

Growing accumulation of wealth

The inclusion of a goal to reduce inequalities is one of the major strengths of the SDGs, but the challenge is even more immense than Goal 10’s targets suggest. Although there is a target on income disparities (10.1), [fn] Target 10.1 does not really take aim at income inequality per se (i.e., the gap between the rich and the poor), but rather is based on the World Bank’s measure of ‘shared prosperity’ –the share of the bottom 40 percent of the income distribution increasing faster than the average. [/fn] wealth inequality goes overlooked despite being one of the major drivers of disparities across the world.

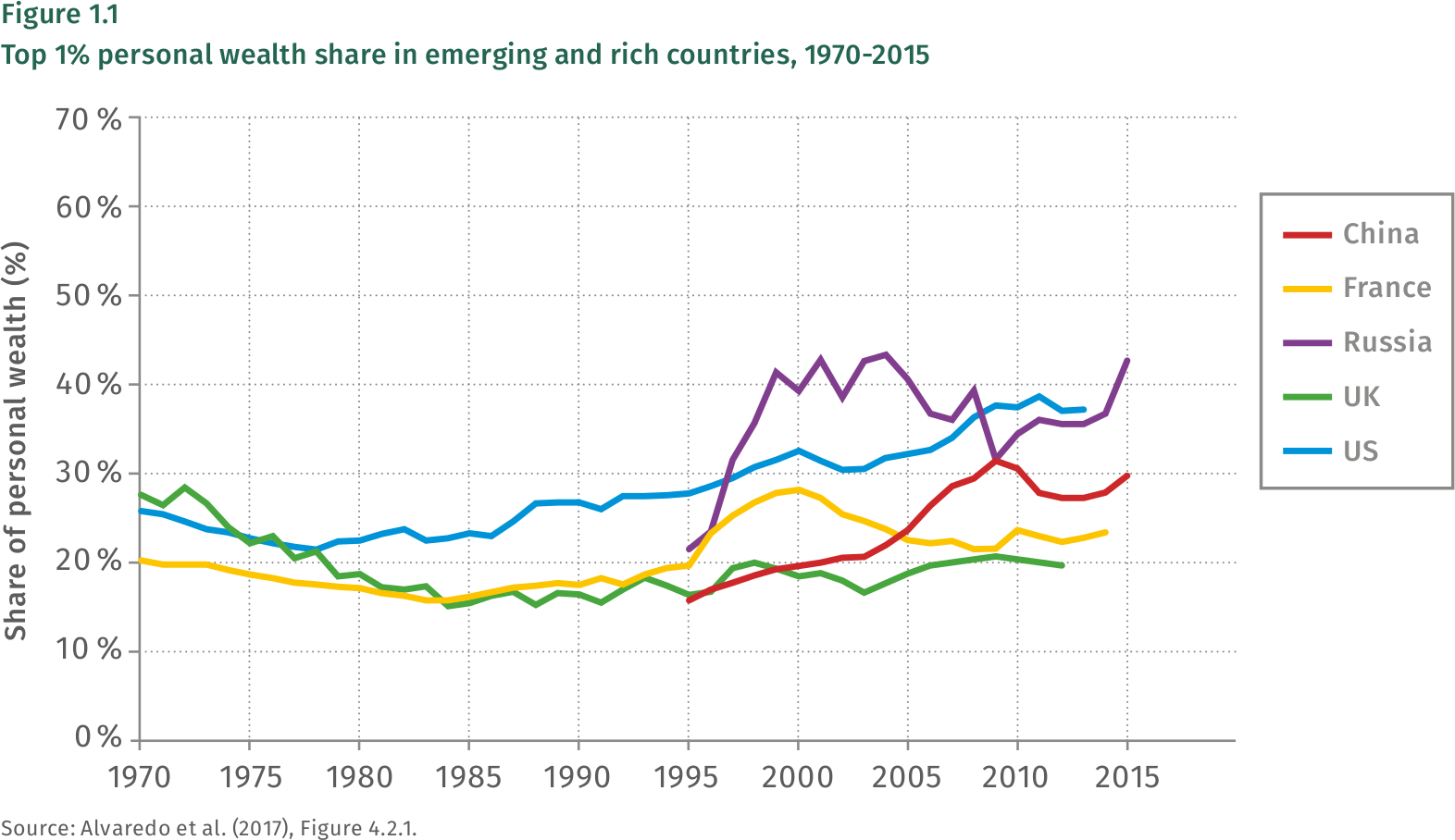

Many studies have shown that wealth inequality is even deeper and more pernicious than income inequality. According to estimates by the Credit Suisse Research Institute, the bottom half of the global population own less than 1 percent of total wealth. In sharp contrast, the richest 10 percent hold 88 percent of the world’s wealth, and the top 1 percent alone account for 50 percent of global assets. [fn] Credit Suisse (2017), p. 110, figures for 2017. [/fn] As Branko Milanovic writes, “wealth inequality is even more extreme [than income inequality] for every country for which we have reliable data”. [fn] Milanovic (2018). [/fn] These disparities also reinforce each other, as wealth typically generates income: in 2014, 67.4 percent of the pre-tax income of the top 0.1 percent in the USA was income from wealth (capital gains, interest, dividends, etc.). [fn] Piketty et al. (2018), Data Appendix (http://gabriel-zucman.eu/files/PSZ2017MainData.xlsx). [/fn] In most emerging and rich countries the wealth share of the top 1 percent has been rising steadily over the last two to three decades (see Figure 1.1).

The vicious circle of inequality

Wealth – ownership of property, land or shares, for example – confers not just economic security but also social and political power. As Jeff Spross of The Week points out, “who owns wealth ultimately determines who rules”. [fn] http://theweek.com/articles/717294/wealth-inequality-even-worse-than-income-inequality. [/fn] This situation creates a ‘vicious circle of inequality’, whereby growing economic inequality heightens political inequality, which then increases the ability of corporations and rich elites to influence policy-making to protect their wealth and privileges. Meanwhile the power of labour unions, for example, is increasingly eroded. [fn] Jaumotte/Osorio Buitron (2015). [/fn] Milanovic states that “higher levels of inequality seem to be economically beneficial for the rich, who are often able to translate their disproportionate control of resources into disproportionate influence over political and economic decision-making.” [fn] Milanovic (2018). [/fn]

This is largely because wealth buys influence, [fn] See Donald (2017) for more on nexus of concentrated political and economic power. [/fn] including through directly financing political campaigns. In the USA, the ultra-rich top 0.01 percent contributed 40 percent of the total election campaign contributions in 2016. [fn] See: www.nytimes.com/2018/02/15/opinion/democracy-inequality-thomas-piketty.html. [/fn] In many contexts, legislators are drawn almost exclusively from the wealthiest classes of society. Wealth also buys access to the services of lawyers, accountants and lobbyists, which The New York Times terms the “income defense industry”, “a high-priced phalanx of lawyers, estate planners, lobbyists and anti-tax activists who exploit and defend a dizzying array of tax maneuvers, virtually none of them available to taxpayers of more modest means”. [fn] Scheiber/Cohen (2015). [/fn]

Wealth also tends to persist over generations, thereby constraining social mobility. Wealth disparities on the basis of race and gender for example, tend to be far greater than those for income. [fn] http://prospect.org/article/race-wealth-and-intergenerational-poverty [/fn] While many people may suffer losses as a consequence of a financial crisis, it is the poorest and most marginalized who are hardest hit due to lack of a cushion. In many countries women bore the burden of the global financial crisis of 2007-2009 (and the subsequent austerity measures). [fn] Donald/Lusiani (2017). [/fn] In the USA, recessions have disproportionately affected black and Latino families. [fn] Ibid. [/fn]

Why extreme wealth inequality is inimical to the 2030 Agenda

The concentration of wealth directly or indirectly affects all elements of the 2030 Agenda. Extreme economic inequality is, for instance, integrally linked with persistent and chronic poverty (SDG 1). Indeed, several studies have shown that SDG 1 will not be achieved unless extreme income and wealth inequality is also tackled. The resources that are captured by wealthy people and entities will be essential to robustly tackle poverty. To give one example, the richest man in Nigeria, Aliko Dangote, founder of Africa’s largest cement producer, earns enough interest on his wealth in one year to lift 2 million people out of extreme poverty. [fn] Oxfam (2018), p. 10 and www.forbes.com/profile/aliko-dangote/?list=billionaires. [/fn] Hence it is not surprising that Oxfam, like other civil society organizations, conclude: “To end extreme poverty, we must also end extreme wealth” [fn] Oxfam (2018), p. 17. [/fn] .

In terms of gender inequality (SDG 5), women’s rights are systematically undermined by the same systems which create and perpetuate monopolies of power and wealth. At the simplest level, 90 percent of people on the Forbes billionaires list are men, and the gender wealth gap tends to be even larger than the gender pay gap. In the USA, white women own only 32 cents for every dollar owned by a white man, and women of color even less. [fn] Oxfam (2018), p. 25. [/fn]

Wealth inequality reflects, entrenches and worsens the various inequalities women face, cutting across several SDGs. A report by UN Women on the implementation of the SDGs from a gender perspective finds that in Cameroon, for example, while just over 30 percent of women are illiterate, among the poorest 20 percent of women, more than 80 percent are illiterate. [fn] UN Women (2018), p. 85. [/fn] In Pakistan, 58.5 percent of women and girls in the lowest 20 percent of the wealth index report having no say in decisions regarding their own healthcare, as opposed to 39.3 percent in the wealthiest quintile, while Colombia’s poorest women are 16.4 times as likely as the wealthiest women to give birth without assistance from a healthcare professional. [fn] Ibid., pp. 153, 167. [/fn] UN Women summarizes: “Wealth inequality and gender-related inequality often interact in ways that leave women and girls from the poorest households behind in key SDG-related areas, including access to education and health services.” [fn] Ibid., p. 144. [/fn]

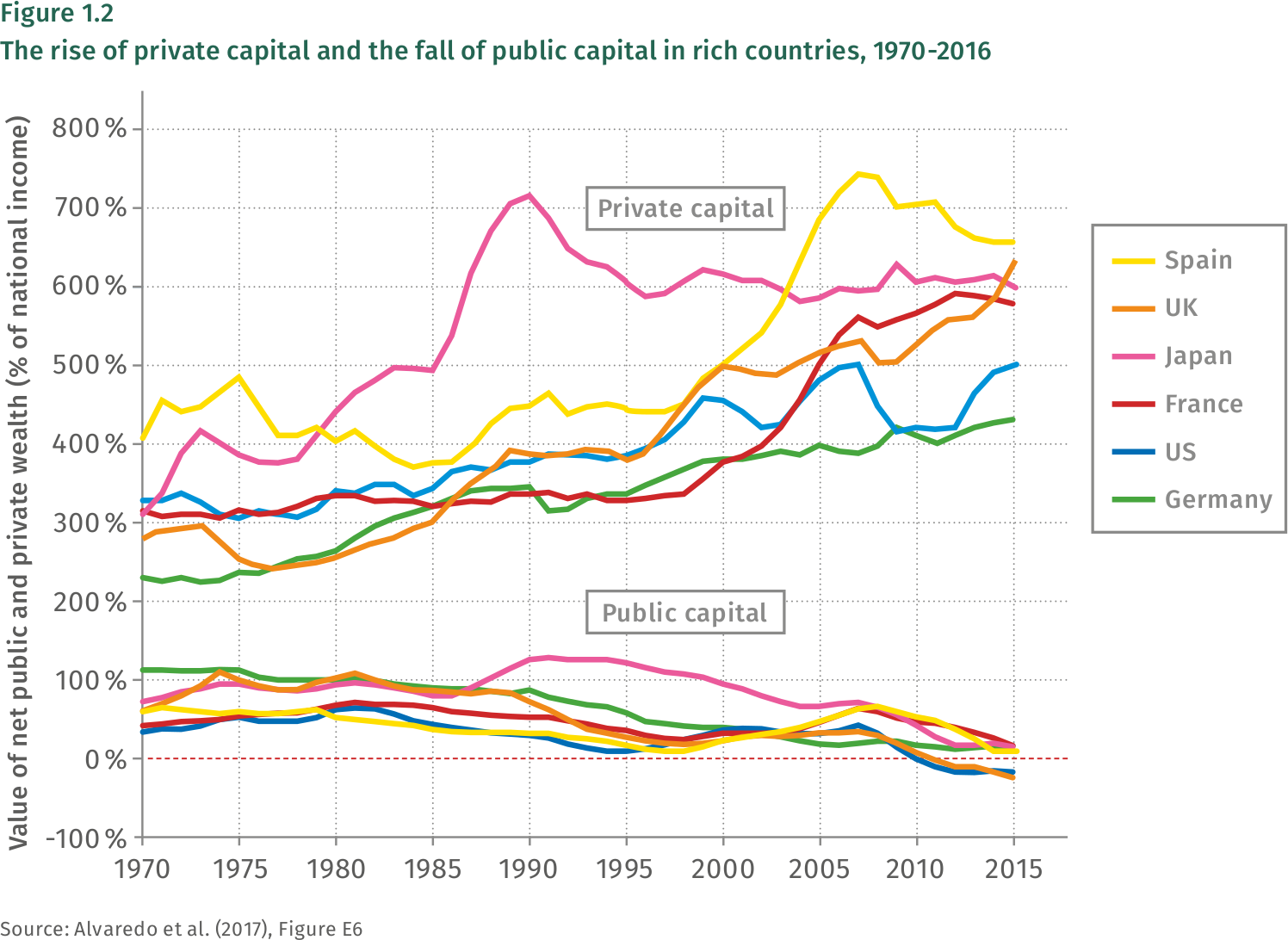

Furthermore, extreme concentration of wealth threatens the achievement of the 2030 Agenda by fundamentally affecting the amount of resources that are available to be spent on sustainable development. As the World Inequality Report 2018 states, “Over the past decades, countries have become richer, but governments have become poor” due to a massive shift towards private capital. [fn] Alvaredo et al. (2017), p. 14. [/fn] As result of the privatization policies of the last decades the amount of public capital is now negative or close to zero in many rich countries (see Figure 1.2). This limits the policy space of governments to tackle inequalities, as well as to implement the SDGs. For example, many of the SDGs – especially 3 (health), 4 (education), 5 (gender equality), 6 (water) and 10 (inequalities) – will ultimately depend on quality, accessible public services, which require robust public financing.

In addition to threatening public service provision, intense wealth concentration is likely to be a major obstacle to creating decent work for all and protecting workers’ rights (SDG 8), given that the power of wealthy elites and large corporations vastly outweighs that of organized labour. Meanwhile, the ability of labour to organize and negotiate has been compromised in many cases, including through pressure on governments from big business.

Very unequal societies are also bad for the environment, [fn] www.theguardian.com/inequality/2017/jul/04/is-inequality-bad-for-the-environment [/fn] and therefore threaten the environmental aspects of the 2030 Agenda. The very rich tend to have a much bigger ecological footprint because they consume more, and high levels of inequality have been shown to work against the mobilization of collective efforts necessary to protect the environment. The ability of the rich to skew decision-making towards their interests may also be detrimental towards the environment, while also ensuring that most of the impacts of climate change and pollution can be ‘dumped’ on people living in poverty. [fn] Islam (2015). [/fn]

These trends could also be an obstacle to achieving Goal 16, particularly regarding effective and accountable institutions and participatory, inclusive and representative decision-making. In general, wealth concentration and the economic processes that have accompanied it – such as intense financialization – distort decision-making in ways that could well be fatal to the prospects of realizing the 2030 Agenda. Increasingly, for example, it is financial firms that have the power to make decisions about what infrastructure projects are most important (i.e. likely to produce return on investment), rather than the people affected democratically deciding what is most socially valuable.

Growing corporate concentration

Extreme inequalities in individual wealth are also interrelated with growing market concentration. Many sectors of the global economy are dominated by a small number of transnational corporations, giving them vast power over these markets. The main beneficiaries of these oligopolistic market structures are the companies’ largest shareholders and main owners, some of whom have made it to the top of the world’s billionaires list. Striking examples are Jeff Bezos of Amazon, Bill Gates of Microsoft, Mark Zuckerberg of Facebook, and Carlos Slim of America Movil. Slim has established an almost complete monopoly over telephone and broadband communications services in Mexico, which, according to the OECD, had significant negative effects for consumers and the economy – but obviously positive effects for Slim’s fortune. [fn] Oxfam (2018), p. 11. [/fn]

Particularly alarming for the implementation of SDG 2 are the concentration processes and mega-mergers in the agrifood industry – in all phases along the value chain. [fn] See IPES-Food (2017) and the comprehensive Agrifood Atlas, published by Heinrich Böll Foundation/Rosa Luxemburg Foundation/Friends of the Earth Europe (2017). [/fn] The global trade of agricultural commodities, from wheat, corn and soybeans to sugar, palm oil and rice, is dominated by only five companies. Meanwhile, if all of the currently planned mergers in the seed and agrochemical sector are allowed, the new corporate giants will together control as much as 70 percent of the market for agrochemical products and more than 60 percent of the global seed market. [fn] IPES-Food (2017), pp. 21ff. [/fn]

Market concentration and the growing role of a few global players are also evident in other areas relevant to the SDGs. Relatively small groups of transnational corporations dominate, for instance, the mining sector, the global oil and gas market, and the car industry. They influence, and often undermine, effective measures against climate change and the transformation towards sustainable energy systems (SDGs 7 and 13). The extractive industries play a similar role in unsustainable consumption and production (SDG 12), particularly with the rush to mine in the deep sea (SDG 14). Corporate concentration has also been shown to cost jobs and reduce wages, with implications for SDG 8. [fn] Covert (2018). [/fn]

Transnational banks, institutional investors and asset management firms, who are major drivers of these trends, have themselves experienced massive concentration in recent years. Research has found a growing concentration of ownership in the hands of finance capital over the past three decades. [fn] Peetz/Murray Nienhüser (2013). [/fn] A different investigation of the relationships between 43,000 transnational corporations has identified a group of companies, mainly in the financial industry, with disproportionate power over the global economy. According to the study, “transnational corporations form a giant bow-tie structure and […] a large portion of control flows to a small tightly-knit core of financial institutions.” [fn] Vitali/Glattfelder/Battiston (2011). [/fn] At the centre of the bow tie, a core of 147 companies control 40 percent of the network’s wealth, while just 737 companies control 80 percent. One of the most influential is the world’s largest asset management company BlackRock. At the end of 2017, the value of the assets managed by BlackRock was US$ 6.288 trillion, higher than the GDP of Japan or Germany. [fn] http://ir.blackrock.com/file/4048287/Index?KeyFile=1001230787 [/fn] Large institutional investors such as pension funds, insurance funds and sovereign wealth funds are also the drivers of a new generation of public-private partnerships (PPPs) in infrastructure, forcing governments to offer ‘bankable’ projects that meet the needs of these investors rather than the needs of the affected population.

Which policy choices have led us here?

The policy choices that have produced this extreme market concentration and socio-economic inequality are the same fiscal and regulatory policies that led to the weakening of the public sector and enabled the unprecedented accumulation of individual and corporate wealth. Some governments have actively promoted these policies, in other cases they have been imposed from abroad, notably by the International Monetary Fund (IMF) and powerful public and private creditors.

The cutbacks in public services and other ‘austerity measures’ governments claimed were necessary to keep them solvent in the aftermath of the financial crisis of 2008-9 led to a wave of privatization, particularly in public service provision and infrastructure. The first pieces of ‘family silver’ sold into private hands were such things as water supply, schools, hospitals, railways, roads, harbors and airports. For example, among the measures Greece was forced to adopt in order to meet the terms of its financial assistance packages was a 40-year concession to operate, manage, develop and maintain 14 regional airports in Greece to Fraport, a German transport company. According to a Transnational Institute study, of the 37 regional airports owned by the Greek state, only the 14 that were profitable have been included in the privatization programme, leaving taxpayers to subsidize the unprofitable rest. The study concluded: “Privatisation often means loss of income to the state as valuable public assets are sold for bargain prices to corporations. Profitable state companies that provide annual revenue are sold off, while unprofitable subsidy-consuming assets remain in state hands.” [fn] Vila/Peters (2016), p. 12. [/fn]

The global financial crisis also exacerbated the ongoing erosion of labour rights, which has been a major factor in rising income and wealth inequality. Historically, unions have played a crucial role in the protection of economic and social rights, and have helped to close gender [fn] See: https://statusofwomendata.org/women-in-unions/. [/fn] and racial [fn] See: http://cepr.net/press-center/press-releases/benefits-of-union-membership-narrow-racial-wage-inequal…. [/fn] wage gaps. There is now strong evidence that lower unionization has been associated with an increase in top income shares in advanced economies. [fn] Jaumotte/Osorio Buitron (2015). [/fn] Contributing policies included the cessation of national general agreements, roll-backs in policy support for multi-employer bargaining and legislative changes that favoured corporate rights over labor rights, for example introducing the possibility for companies in trouble to opt out of sectoral agreements. [fn] Visser/Hayter/Gammarano (2015). [/fn]

Increasing inequality has also been fueled by the financialization of sectors such as housing. In Spain, for example, the housing bubble has been identified as the main cause of the unprecedented rise in the personal wealth to national income ratio. [fn] Alvaredo et al. (2017), pp. 230ff. [/fn] In Argentina, there are 750,000 unoccupied and speculative housing units, while excessive speculation in the real estate sector has pushed up prices to the point where many people (especially in urban areas) are not able to enjoy their right to safe and secure housing. [fn] CELS (2017). [/fn] In Buenos Aires, the amount of people in situations of homelessness rose by 20 percent in 2016. [fn] www.cels.org.ar/web/2017/07/ciudad-de-buenos-aires-mas-de-4000-personas-estan-en-situacion-de-calle/ [/fn] Current zoning laws and tax policies have been identified as enabling property speculation practices. [fn] CELS (2017). [/fn]

Existing competition and anti-trust laws at national and international level have evidently been too weak to prevent mega-mergers and to curtail the massive growth of financial conglomerates with disproportionate influence on the global economy. During the financial crisis of the late 2000s, bailouts and stimulus programmes rescued the global banking system but failed to curtail the growth of large banks and insurance companies. On the contrary, financial mergers and acquisitions were an integral element of the response.

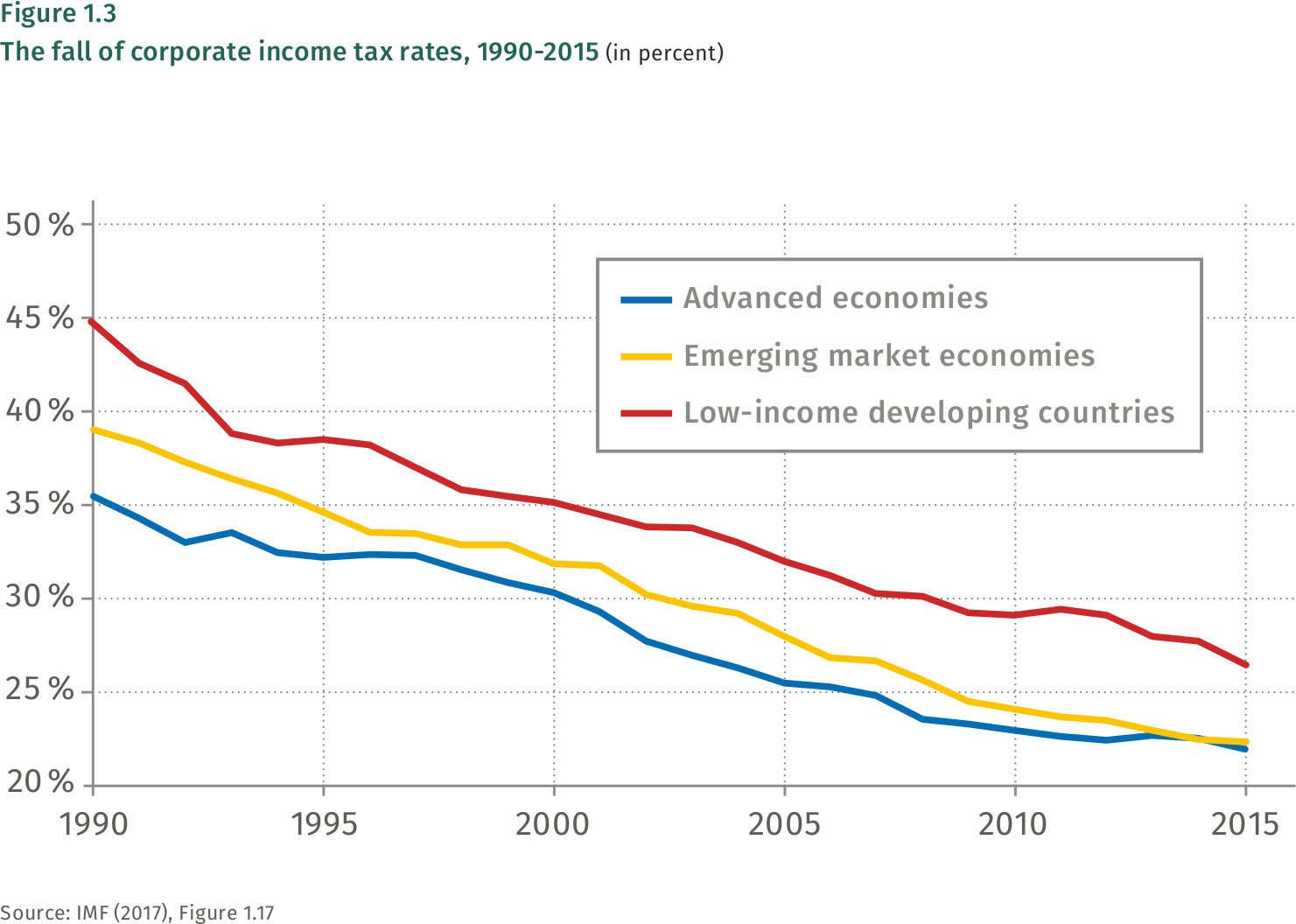

But perhaps the most important factor in driving the concentration of wealth and economic power has been the adoption of more regressive tax policies in most regions of the world, with increased reliance on indirect taxes such as value-added tax (VAT) to raise revenue, declining corporate and personal income tax rates on the highest earners, and low revenue from property and inheritance taxes (if any). Mean statutory corporate income tax rates have declined by 13 to 18 percentage points over the past 25 years (see Figure 1.3). [fn] Crivelli et al. (2015), p. 11. [/fn]

Meanwhile, expenditures on public services and social protection – which represent a crucial form of wealth redistribution and play an essential role in realizing human rights – have been cut back in many countries. [fn] See for instance www.cesr.org/factsheet-brazils-human-rights-advances-imperiled-austerity-measures. [/fn] Despite all the rhetoric around belt-tightening and austerity being the only option, more progressive alternatives such as raising tax rates on higher earners, eliminating tax incentives for multinational corporations, or better enforcing the collection of property taxes, have typically been ignored or dismissed as unfeasible.

Even those countries which bucked this trend in recent decades, such as Brazil, are now experiencing a shift towards more punitive, regressive policies, particularly with regards to public spending, with potentially severe impacts on marginalized and disadvantaged communities. [fn] Ibid. [/fn] Indeed, the negative impact of these trends in fiscal policy has fallen disproportionately on those who can least afford to pay; the gendered impacts of austerity measures and regressive taxation are, for example, well-documented. [fn] See www.brettonwoodsproject.org/2017/09/imf-gender-equality-expenditure-policy/ and www.brettonwoodsproject.org/2017/04/imf-gender-equality/. [/fn]

The lack of political will or at least effective concerted action to tackle the cross-border dimension of tax evasion and tax avoidance has further facilitated the accumulation of wealth and economic power. As most recently revealed in the so-called Panama and Paradise Papers, a large proportion of the profits and wealth of transnational corporations and rich individuals is held offshore in tax havens. This exacerbates inequalities as it deprives countries of revenue that could be used to finance social protection systems and quality public services essential for universalizing enjoyment of economic and social rights. It also leads to a significant under-estimation of the scale of inequality. According to recent estimates, the super-wealthy are hiding at least US$ 7.6 trillion from the tax authorities. [fn] Oxfam (2018), p. 11. [/fn]

There are alternatives

Crucially, there are robust and progressive alternatives to these policy trends which would help to redistribute wealth and power, and thereby begin to tackle one of the fundamental structural obstacles to the fulfilment of sustainable development and human rights commitments.

Governments urgently need to implement fiscal and regulatory policies which respond to the massive accumulation of individual wealth, and to generate and redistribute resources in a way more aligned with human rights principles and standards [fn] See for example Article 2 of the International Covenant on Economic, Social and Cultural Rights, in which each State party undertakes “to take steps, individually and through international assistance and co-operation, especially economic and technical, to the maximum of its available resources, with a view to achieving progressively the full realization of the rights recognized in the present Covenant”. [/fn] , including through the provision of quality public services accessible to all. It is important to recognize, however, that tackling inequality is not just a technocratic matter. Extreme inequality is deeply connected with power hierarchies, institutions, culture and politics. As the Society for International Development (SID) notes regarding East Africa, efforts to address inequality are “unlikely to be successful in the absence of a committed attempt to dismantle and recreate the institutions that distribute power and the networks that have emerged to extract benefits from them”. [fn] Society for International Development (2016). [/fn] Hence, policy reform is necessary but not sufficient, and a sectoral approach is likely to address only the tip of the iceberg. Meaningfully tackling economic inequality requires more holistic and more sweeping shifts in where and how power is vested, including through institutional, legal, social, economic and political commitments to realizing human rights.

Human rights standards – particularly those related to substantive equality and non-discrimination, to the progressive realization of economic, social and cultural rights, and to the duty of states to cooperate internationally in the fulfilment of these rights – provide detailed and comprehensive normative guidance to states on the action they must take to reduce economic inequality within and between countries, and how it intersects with gender, racial and other dimensions of inequality. [fn] For more on the role human rights standards can play in guiding efforts to tackle economic inequality, including as part of efforts to implement the SDGs, see Center for Economic and Social Rights (2016). [/fn]

As governments pursue the reforms that are necessary, inter alia, in the areas of national tax and budget policies, international tax cooperation, competition laws and anti-trust regimes, and financial market regulation, human rights principles and standards should guide the policy choices, implementation and the outcomes sought. Essential elements of a reform package are:

- Emphasizing progressive taxation: Taxation should be based on the ability to pay, with rich individuals and large corporations assuming the major part of the burden (and not given an ‘easy way out’ through loopholes). A flat and undifferentiated value-added tax (VAT) is regressive, disproportionately burdens the poor, and therefore should not constitute the centrepiece of the tax system. A high degree of attention should instead be given to highly progressive income tax, corporation tax, and taxes on wealth and assets, such as property, capital gains and estates/inheritance. Comprehensive wealth taxes should be carefully considered; Thomas Piketty, for example, has suggested a progressive annual tax on individual net worth for the wealthiest people on the planet, for example at a rate of 1 percent for a wealth of 1-5 million Euros and 2 percent above 5 million Euros. [fn] Piketty (2014). [/fn] Any form of indirect taxation should be made as pro-poor as possible, for example through more thorough exemptions on basic goods and higher rates on luxury items. Taxation systems must also be designed with the goal of gender equality in mind, with particular attention to how tax systems affect the amount and distribution of unpaid care work.

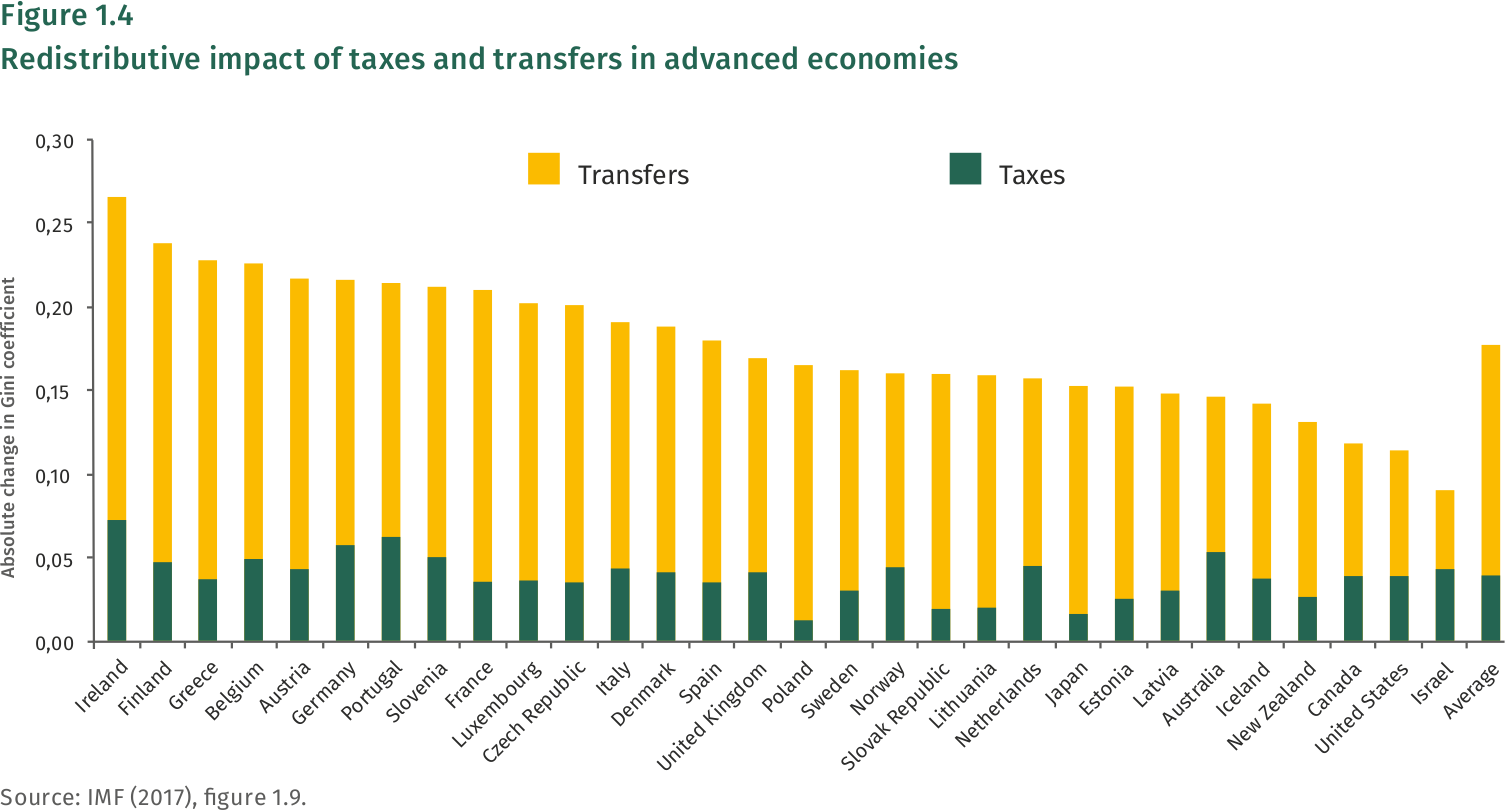

- Making full use of the redistributive potential of budget policies: With the 2030 Agenda, governments have committed to progressively achieve greater equality through targeted fiscal, wage, and social protection policies (SDG target 10.4). Redistribution through fiscal policy works; the Gini coefficient of income distribution after taxes and social transfers is often more than 0.2 percentage lower than the Gini coefficient of market income (see Figure 1.4). However, in many countries the redistributive potential of fiscal policy is often grossly underutilized. [fn] Center for Economic and Social Rights (2018). [/fn] Participatory budgeting and gender budgeting can be important tools in this regard.

- Improve public services and establish universal, comprehensive social protection systems: To create more equal distribution of power and realize human rights (e.g., to water, health, education and social security) it is also crucial that the quality and reach of public services be improved, and that social protection be expanded. Universalizing access to quality public services are an effective way of redistributing opportunities, well-being, wealth and power. The establishment of social protection floors (itself enshrined in SDG target 1.3) is another essential policy measure to reduce inequality, although ‘floors’ should be a step on the way to more comprehensive social protection systems which are transformative rather than merely ameliorating the worst effects of the current economic system. The human right to social security (social protection) is already a legal obligation of most States, enshrined in the Universal Declaration of Human Rights and the International Covenant on Economic, Social and Cultural Rights. The ILO has shown that universal social protection floors are in general affordable for all countries. [fn] www.social-protection.org/gimi/gess/RessourcePDF.action?ressource.ressourceId=54915. See also the Spotlight on SDG 1 in this report. [/fn]

Undoubtedly, all and any measures must be gender-responsive if they are to meet their promise of promoting equality and realizing human rights. This includes careful consideration of women’s disproportionate burden of unpaid care work – the reduction and redistribution of which should be a primary aim of public services and social protection systems. Therefore, increasing access to and quality of care services (elder care as well as childcare) should be a major priority. [fn] See Chapter 4 on “care systems and SDGs: reclaiming policies for life sustainability” below. [/fn] - Implement and enforce minimum wages and guarantee labour rights, including the right to decent work, equal pay, and the right to organize and collective bargaining. Shifting the balance of power away from capital and finance and towards workers is crucial for redressing inequalities and achieving the SDGs. Minimum wages should be set at a level consistent with what is needed to live in dignity and enjoy the human right to an adequate standard of living. Regulating wage ratios between lowest and highest paid earners in a business could also be considered; at the very least wage ratios and gender wage gaps should be disclosed for public scrutiny.

- Reinforce initiatives against tax abuses and illicit financial flows: A bundle of national and international measures is needed to strengthen fiscal authorities, close tax loopholes and prevent capital flight. [fn] See also the Spotlights on SDG 16 and Box 1 in this report. [/fn] These include:

- Effective measures against the manipulation of transfer pricing.

- Mandatory country-by-country reporting standards for transnational corporations.

- Binding rules for the automatic exchange of tax information between state agencies.

- Effective support for stolen assets recovery as described in the UN Convention against Corruption.

- Tracking the beneficial ownership of assets which are held (offshore) by entities and arrangements like shell companies, trusts and foundations. According to the World Inequality Report 2018, a global financial register recording the ownership of equities, bonds, and other financial assets could deal a severe blow to financial opacity. More transparent systems already exist in countries like Norway and China, which suggest that transparency is technically and economically feasible. [fn] Alvaredo et al. (2017), pp. 263ff. [/fn]

- Banning financial transactions in tax havens and secrecy jurisdictions – as well as closing down havens for illicit money.

- Applying the ‘polluter pays’ principle to the financial sector – introducing a Financial Transaction Tax (FTT): An FTT should be levied on trading shares, bonds, derivatives and foreign currency at the stock exchange, at trade centres and in over-the-counter transactions. Imposition of the tax ought to be internationally coordinated, but individual countries or groups of countries should be encouraged to start applying it even before it becomes global, for example the 10 countries that are participating in the proposal of the European Commission to implement a FTT using “enhanced co-operation”.

- Strengthening competition and anti-trust policies: Governments should strengthen instruments and institutions to enable them to break up oligopolistic structures. They should strengthen national and regional anti-trust laws, cartel offices and competition regulators, as well as global anti-trust policies, cooperation and legal frameworks under the auspices of the UN (including giving due consideration to the proposal for a UN Convention on Competition).

- Tackling the ‘too big to fail’ problem – In order to prevent future global financial crises, governments should no longer allow companies and banks to grow in unlimited fashion. The separation of commercial banking and investment banking has to be reconsidered and adapted to the 21st century. Moreover, more effective international regulation is required to avoid the destabilizing effects of hedge funds and private equity funds on the global financial system. This could include a ban on pension funds and insurances investing in highly speculative funds.

- Regulating and restricting money in politics: including through more stringent anti-corruption, disclosure and reporting laws regarding corporate lobbying, political donations and access to policy-makers and policy processes.

- Curbing property speculation: Given that property speculation and the financialization of housing is a major cause of rising inequality, homelessness and insecure housing, more countries should consider a kind of ‘property speculation tax’, as implemented in a rudimentary way in Germany, which would levy punitive rates on speculators or those who own second homes and empty properties. [fn] www.theguardian.com/commentisfree/2018/jan/27/building-homes-britain-housing-crisis [/fn] In Spain the autonomous community of Navarra passed a measure allowing the public expropriation of any housing that had remained vacant for two years. [fn] www.abc.es/economia/abci-constitucional-avala-navarra-pueda-expropiar-viviendas-desocupadas-anos-20… [/fn]

In sum, there are robust and progressive policy alternatives, which could effectively counteract the excessive concentration of economic power. Implementing such policies will be a prerequisite to unleash the transformative potential of the 2030 Agenda and to realize human rights, as part of and alongside a bigger shift in how power is distributed nationally and globally.

Kate Donald is Director of the Human Rights in Sustainable Development Program at the Center for Economic and Social Rights (CESR), Jens Martens is Director of Global Policy Forum (GPF).

Alstadsæter, Annette/Johannesen, Niels/ Zucman, Gabriel (2017): Tax Evasion and Inequality. Norwegian University of Life Sciences/University of Copenhagen/UC Berkeley and NBER.

http://gabriel-zucman.eu/files/AJZ2017.pdf

Alvaredo, Facundo/Chancel, Lucas/Piketty, Thomas/Saez, Emmanuel/Zucman, Gabriel (2017): World Inequality Report 2018.

http://wir2018.wid.world/files/download/wir2018-full-report-english.pdf

Bahn, Kate (2018): Education won’t solve inequality: not without workers‘ power too. In: Slate, 30 May 2018. https://slate.com/human-interest/2018/05/study-unions-increasingly-represent-educated-workers.html

Center for Economic and Social Rights (2018): Fiscal Policies and the Safeguarding of Economic, Social and Cultural Rights in Latin America (Thematic report executive summary). New York.

http://cesr.org/executive-summary-report-iachr-fiscal-policies-and-escr-latin-america

Center for Economic and Social Rights (2016): From Disparity to Dignity: Tackling economic inequality through the Sustainable Development Goals. New York.

http://www.cesr.org/disparity-dignity-inequality-and-sdgs

Centro de Estudios Legales y Sociales (CELS) (2017): Consenso Nacional para un Hábitat Digno. Buenos Aires.

www.cels.org.ar/web/wp-content/uploads/2017/07/HD_web.pdf

Covert, Bryce (2018): When Companies Supersize, Paychecks Shrink. In: The New York Times, 13 May 2018.

www.nytimes.com/2018/05/13/opinion/mergers-companies-supersize-workers-wages.html

Credit Suisse (2017): Global Wealth Databook 2017.

http://publications.credit-suisse.com/index.cfm/publikationen-shop/research-institute/global-wealth…

Crivelli, Ernesto/de Mooij, Ruud A./Keen, Michael (2015): Base Erosion, Profit Shifting and Developing Countries. Washington, D.C.: IMF.

www.sbs.ox.ac.uk/sites/default/files/Business_Taxation/Docs/Publications/Working_Papers/Series_15/W…

Donald, Kate (2017): Squeezing the State: corporate influence over tax policy and the repercussions for national and global inequality. In: Civil Society Reflection Group on the 2030 Agenda for Sustainable Development: Spotlight on Sustainable Development 2017 – Reclaiming policies for the public. New York/Bonn/Montevideo, pp. 97-100.

www.2030spotlight.org/en/book/1165/chapter/10-squeezing-state-corporate-influence-over-tax-policy-a…

Donald, Kate/Lusiani, Nicholas (2017): The gendered costs of austerity: Assessing the IMF’s role in budget cuts which threaten women’s rights. Bretton Woods Project, London.

http://socialprotection-humanrights.org/wp-content/uploads/2017/10/Gendered-Costs-of-Austerity-2017…

Florquin, Nicolas (2011): A booming business: Private security and small arms. In: Small Arms Survey (2011), pp. 101-133.

Hardoon, Deborah (2015): Wealth: Having It All and Wanting More. Oxford: Oxfam (Oxfam Issue Briefing).

www.oxfam.org/sites/www.oxfam.org/files/file_attachments/ib-wealth-having-all-wanting-more-190115-e…

Heinrich Böll Foundation/Rosa Luxemburg Foundation/Friends of the Earth Europe (2017): Agrifood Atlas. Facts and figures about the corporations that control what we eat. Berlin/Brussels.

www.boell.de/en/agrifood-atlas

IMF (2017): IMF Fiscal Monitor 2017: Tackling Inequality. Washington, D.C.

www.imf.org/en/publications/fm/issues/2017/10/05/fiscal-monitor-october-2017

IPES-Food (2017): Too big to feed: Exploring the impacts of mega-mergers, concentration, concentration of power in the agri-food sector.

www.ipes-food.org/images/Reports/Concentration_FullReport.pdf

Islam, S. Nazrul (2015): Inequality and environmental sustainability. UN DESA Working Paper No. 145. New York: UN.

www.un.org/esa/desa/papers/2015/wp145_2015.pdf

Jaumotte, Florence/Osorio Buitron, Carolina (2015): Power from the People. In: Finance and Development 52:1, March 2015.

www.imf.org/external/pubs/ft/fandd/2015/03/jaumotte.htm

Jomo KS/Chowdhury, Anis/Sharma, Krishnan/Platz, Daniel (2016): Public-Private Partnerships and the 2030 Agenda for Sustainable Development: Fit for purpose? New York: UN Department of Economic & Social Affairs (DESA Working Paper No. 148, ST/ESA/2016/DWP/148).

https://sustainabledevelopment.un.org/content/documents/2288desaworkingpaper148.pdf

Lewis, Jamie M. (2015): Another View of the Gender Earnings Gap. Washington, D.C.: U.S. Census Bureau.

https://census.gov/newsroom/blogs/random-samplings/2015/11/another-view-of-the-gender-earnings-gap…

Milanovic, Branko (2018): There are two sides to today’s global income inequality. In: The Globe and Mail, January 22, 2018.

www.theglobeandmail.com/report-on-business/rob-commentary/the-two-sides-of-todays-global-income-ine…

Milanovic, Branko (2016): Global Inequality – A New Approach for the Age of Globalization. Cambridge, MA and London.

Oxfam (2018): Reward work, not wealth. Oxford.

www.oxfam.org/sites/www.oxfam.org/files/file_attachments/bp-reward-work-not-wealth-220118-en.pdf?ci…

Oxfam America (2017): Rigged Reform: US companies are dodging billions in taxes but proposed reforms will make things worse. Media briefing April 2017.

www.oxfamamerica.org/static/media/files/Rigged_Reform_FINAL.pdf

Peetz, David/Murray, Georgina/Nienhüser, Werner (2013): The New Structuring of Corporate Ownership. In: Globalizations, 10:5, pp. 711-730.

https://doi.org/10.1080/14747731.2013.828965

Piketty, Thomas (2014): Capital in the Twenty-First Century. Cambridge, MA und London.

Piketty, Thomas/Saez, Emmanuel/Zucman, Gabriel (2018): Distributional National Accounts: Methods and estimates for the United States. In: The Quarterly Journal of Economics (2018), 1–57.

http://gabriel-zucman.eu/files/PSZ2018QJE.pdf

Scheiber, Noam/Cohen, Patricia (2015): For the Wealthiest, a Private Tax System That Saves Them Billions. In: The New York Times, 29 December 2015.

www.nytimes.com/2015/12/30/business/economy/for-the-wealthiest-private-tax-system-saves-them-billio…

Society for International Development (2016): State of East Africa Report 2016. Nairobi/Rome.

The Economist Intelligence Unit (2015): The road from principles to practice. Today’s challenges for business in respecting human rights. Geneva/London/Frankfurt/Paris/Dubai.

www.economistinsights.com/sites/default/files/EIU-URG%20-%20Challenges%20for%20business%20in%20resp…

UN (2015a): Addis Ababa Action Agenda of the Third International Conference on Financing for Development. New York (UN Dok. A/RES/69/313).

www.un.org/esa/ffd/wp-content/uploads/2015/08/AAAA_Outcome.pdf

UN (2015b): Transforming our world: the 2030 Agenda for Sustainable Development. New York (UN Doc. A/RES/70/1).

https://sustainabledevelopment.un.org/post2015/transformingourworld

UN Women (2018): Turning promises into action: Gender equality in the 2030 Agenda for Sustainable Development. New York.

www.unwomen.org/en/digital-library/publications/2018/2/gender-equality-in-the-2030-agenda-for-susta…

Vila, Sol Trumbo/Peters, Matthijs (2016): The Privatising Industry in Europe. Amsterdam: Transnational Institute.

www.tni.org/files/publication-downloads/tni_privatising_industry_in_europe.pdf

Visser, Jelle/Hayter, Susan/Gammarano, Rosina (2015): Trends in collective bargaining coverage: stability, erosion or decline? Geneva: ILO (ILO Issue Brief No. 1).

www.ilo.org/wcmsp5/groups/public/ – -ed_protect/ – -protrav/ – -travail/documents/publication/wcms_409422.pdf

Vitali, Stefanie/Glattfelder, James B./Battiston, Stefano (2011): The Network of Global Corporate Control. In: PLOS ONE, 6:10.

http://arxiv.org/PS_cache/arxiv/pdf/1107/1107.5728v2.pdf

World Bank (2016): Poverty and Shared Prosperity 2016: Taking on Inequality. Washington, D.C.: World Bank.

www.worldbank.org/en/publication/poverty-and-shared-prosperity