By Bodo Ellmers, Global Policy Forum

Lack of finance is a key reason why many countries of the global South have been harder hit by the COVID-19 crisis, and struggle to recover from it. In this crisis, governments in many countries, especially OECD countries, encouraged even by the IMF, quickly turned to countercyclical fiscal policy and pumped trillions into the economy to protect their economies and populations from the COVID-19 shock. In fact, fully 90 percent of this fiscal stimulus was injected into the economies of high income countries only, since governments of poorer countries lack the resources to do so. Other countries are being left behind, lacking even the hard currency needed to purchase COVID-19 tests and vaccines to halt the spread of the pandemic.

On 23 August 2021 – more than 17 months after the WHO declared COVID-19 a global pandemic - the IMF finally allocated Special Drawing Rights (SDRs) worth US$ 650 billion to its member states, with the objective of channelling more liquidity to countries in need. The SDR is a global reserve asset that the IMF can create ´out of thin air´, when mandated to do so by a majority of member states that hold 85 percent of IMF voting rights. It is based on a basket of five currencies (US-dollar, Euro, British Pound, Yen, Renminbi).[1]

Countries that receive SDRs can either hold them as currency reserves, or exchange them into hard currencies and eventually use them for a wide range of fiscal purposes, including financing imports of vaccines. No matter what use, the SDR allocation of August 2021 was an important “shot in the arm” for cash-starved developing countries, to use the words of IMF Managing Director Kristalina Georgieva.[2] It has been the quantitatively most important financial action by an international financial institution since the beginning of the crisis.

There are however a number of caveats that reduce its value and effectiveness:

- The allocation was ´too little – too late´: Earlier, the resistance of the Trump administration in the USA, whose vote was needed to reach the 85 percent majority, ensured that the approval process there only started after a new government came to power. Moreover, with an allocation of US$ 650 billion, the IMF decided to stay below the threshold that requires approval by the US Congress. Timing and volume of the SDR allocation were therefore not determined by demand, they were shaped by the political circumstances in just one of the 190 IMF member states. The CSO campaign had demanded an SDR allocation of US$ 3 trillion.[3]

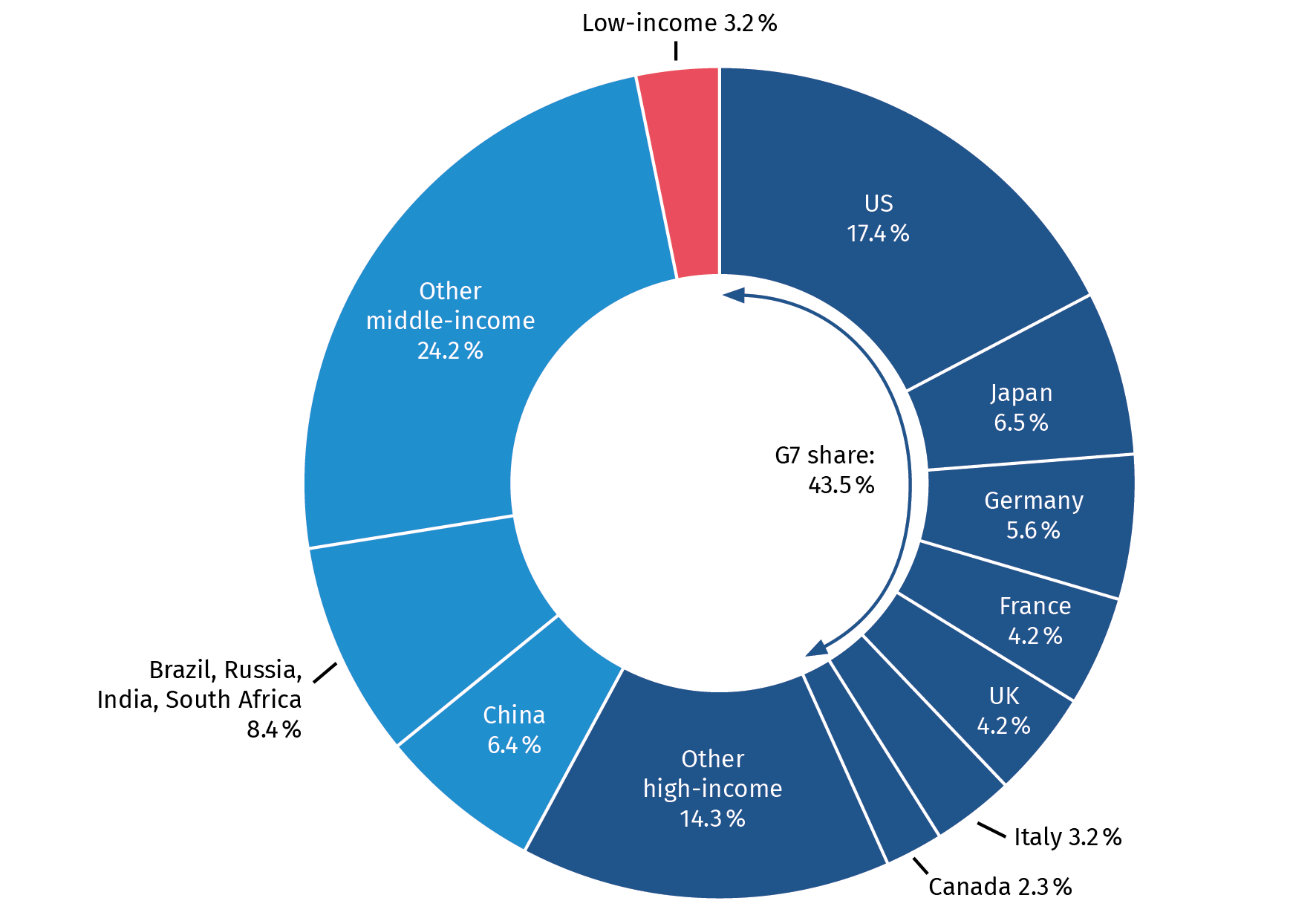

- The lion´s share went to the wrong recipients: The IMF´s Articles of Agreement determine that SDR allocations need to be distributed among member states according to their IMF quota. As richer countries have higher IMF quotas, high-income countries cashed in more than half of the allocation. The G7 countries alone received 43.5 percent of the total, while all low-income countries together received only 3.2 percent. Hence, the countries that need additional liquidity least, got most of it, while only drops trickled through to the cash-starved countries.

Figure 1.5

SDR Allocation by country groups

Source: IMF (https://www.imf.org/en/Topics/special-drawing-right/2021-SDR-Allocation)

To address the latter issue, even the IMF has called on richer member states to rechannel or repurpose a share of their SDR allocation, and the June 2021 G7 Summit in Carbis Bay, UK has set a numerical target of US$ 100 billion.[4] At the time of writing, the discussion about rechannelling is ongoing, and receives mixed support by rich country governments. Many need to overcome internal legal and institutional constraints, or break resistance by their Central Banks who claim ownership of the SDRs.

The IMF´s own facilities, such as the Poverty Reduction and Growth Trust (PRGT) or a still-to-be-founded Resilience and Sustainability Trust (RST), and the Multilateral Development Banks are obvious channels for repurposing SDRs, as they are so-called ‘subscribed’ holders and can receive payments directly in SDRs. CSOs are advocating rechannelling through COVAX or the Green Climate Fund, but this requires first exchanging SDRs into currency such as US-dollars. In any case, CSOs advocate that rechannelling should preserve the specific character of the SDR as a resource that does not create new debts and does not come with political conditionalities attached. Only then can the SDR create an added value to loans from existing IMF facilities.

Lessons learned from this year´s record SDR allocation include that both the IMF as well as many member states need to get their institutional frameworks right in order to ensure that the SDR becomes a more effective tool of crisis financing as well as development financing. Future allocations should be more timely and more demand-driven. Targeted allocations in the first round, would make technically and politically repurposing in the second round unnecessary.

Such reforms are all the more important as SDRs could play a more important role in future. Both the UN as well as CSOs have argued for more than a decade that regular allocations of SDRs should play a crucial role in providing substantial amounts of development financing in a predictable manner. A key development finance position endorsed by a multitude of CSOs is that the IMF issues “250 billion US-Dollars in new SDRs annually, with the allocation based on economic need and the majority going to developing countries, and amending the IMF’s Articles of Agreement to allow this.”[5] Given the persistent failure of the international community to fill SDG financing gaps, it is definitely worth putting a spotlight on the SDR as innovative financing pillar for the 2030 Agenda for Sustainable Development.

[1] https://www.imf.org/en/About/FAQ/special-drawing-right

[2] https://www.imf.org/en/News/Articles/2021/08/23/pr21248-imf-managing-director-announces-the-us-650-billion-sdr-allocation-comes-into-effect

[3] https://www.latindadd.org/2021/02/12/civil-society-organizations-call-for-quick-special-drawing-rights-allocation/

[4] https://www.g7uk.org/wp-content/uploads/2021/06/Carbis-Bay-G7-Summit-Communique-PDF-430KB-25-pages-1-2.pdf

[5] https://www.globaltaxjustice.org/sites/default/files/Eurodad-FfD-position-paper-English1_0.pdf