By Isabel Ortiz, Global Social Justice, and Matthew Cummins, Senior Economist

The high levels of expenditures needed to cope with COVID-19 and the resulting socio-economic crisis have left governments with growing fiscal deficits and debt. Analysis of expenditure projections shows that budget cuts are expected in 159 countries in 2022. The trend continues at least until 2025, with an average of 139 countries expecting budget cuts each year, according to IMF projections.[1] Austerity is projected to affect 6.6 billion people or 85 percent of the world population next year, with around four out of five persons still living under austerity in 2025.[2]

#EndAusterity is a global campaign to stop austerity measures that have negative social impacts. In 2020, more than 500 organizations and academics from 87 countries called on the IMF and ministries of finance to immediately abandon austerity policies, and instead support policies that advance gender justice, reduce inequality and put people and planet first.[3] These organizations, concerned about governments’ ability to fulfil human rights and advance progress towards the SDGs, are alarmed that austerity is returning to the policy agenda. The pandemic has laid bare the deadly repercussions of systematically weak investments in health, education and social protection and their impacts on marginalized populations, including women, older people, racial and ethnic minorities, informal workers and low-income families. This crisis is also shining light on the shrinking middle classes and the widening gaps between the rich and the poor.[4] Rather than cutting spending, governments should be laser focused on creating fiscal space to foster an inclusive and sustainable socio-economic recovery.

Austerity cuts are not inevitable; there are financing alternatives, even in the poorest countries. There is a wide variety of options to expand fiscal space and generate resources for socio-economic post-pandemic recovery. These options are supported by the UN as well as the international financial institutions (IFIs). Governments around the world have been applying them for decades.[5] While it is encouraging that some of these ideas are emerging in policy discussions, much more ambition is needed to provide countries with the funding required to emerge from the pandemic and deliver on the Sustainable Development Goals (SDGs). Precisely, a fundamental human rights principle is that States must utilize all possible resources to realize human rights. The eight main options are summarized below.

- Increasing tax revenues: Taxation is the principal channel for generating resources, which is achieved by altering tax rates—e.g., on corporate profits, financial activities, property, imports/exports, natural resources, digital activities—or by strengthening the efficiency of tax collection methods and overall compliance. Given the increasing levels of inequality, it is important to adopt progressive approaches, taxing those with more income; consumption taxes should be avoided as they are generally regressive and contrary to social progress. Many governments are increasing taxes to achieve greater social investment. For example, Bolivia, Mongolia and Zambia are financing universal pensions, child benefits and other schemes from mining and gas taxes; Ghana, Liberia and the Maldives have introduced taxes on tourism to support social programmes; and Brazil has introduced a tax on financial transactions to expand social protection coverage. Encouragingly, wealth taxes are being proposed in many countries as the best policy to cope with COVID-19.

- Borrowing or debt reduction: Borrowing or debt restructuring/reduction involves active exploration of domestic and foreign borrowing options at low cost, including concessional, following careful assessment of debt sustainability. For countries in high debt distress, restructuring or reducing existing debt should be possible and justifiable if the legitimacy of the debt is questionable and/or the opportunity cost in terms of worsening deprivation of the population is high. In recent years, more than 60 countries have successfully renegotiated debts, and more than 20 have defaulted or repudiated public debt; examples include Ecuador, Iceland and Iraq, which invested debt service savings to social programmes. Since COVID-19, the G20’s Debt Service Suspension Initiative (DSSI) and the IMF’s Catastrophe Containment and Relief Trust (CCRT) have provided some relief, but so much more is needed.

- Eliminating illicit financial flows: Estimated at more than ten times the size of all development aid, a titanic amount of resources criminally escapes developing countries each year. To date, little progress in eliminating this outflow has been achieved, but policy-makers should devote greater attention to cracking down on money laundering, bribery, tax evasion, trade mispricing and other financial crimes that are both illegal and deprive governments of revenues for socio-economic development.

- Expanding social security coverage and formalizing workers in the informal economy: For social protection, increasing coverage and therefore the collection of social insurance contributions is a sustainable way to finance expanded social protection; remarkable examples can be found in Uruguay’s Monotax and Brazil’s SIMPLES, as well as in Argentina, Tunisia and many other countries that have demonstrated the power of formalizing and protecting people that were working in the informal economy.

- Re-allocating public expenditures: Re-allocation of public spending involves adjusting budget priorities and/or replacing high-cost, low-impact investments with those with larger socio-economic impacts. For example, Costa Rica and Thailand reduced spending on the military in order to fund universal health services.

- Using fiscal and central bank foreign exchange reserves: Such measures include drawing down fiscal savings and other State revenues stored in special funds, such as sovereign wealth funds, and/or using excess foreign exchange reserves in the central bank for domestic and regional development. Chile, Norway and Venezuela, among others, have pursued these strategies to increase socio-economic investments.

- Lobbying for aid and transfers: Aid lobbying requires engaging donor governments, international financial institutions and regional development organizations to ramp up North-South or South-South transfers, including through grants and concessional loans.

- Adopting a more accommodating macroeconomic framework: Adoption of an enabling macroeconomic framework entails allowing for higher budget deficit paths and/or higher levels of inflation without jeopardizing macroeconomic stability. Many developing countries adopted these strategies during the global financial and economic crisis to support socio-economic recovery at a time of low growth. In high-income countries, quantitative easing was commonly used, whereby a central bank purchases government bonds or other financial assets in order to inject money into the economy as a form of stimulus. These measures have also been widely applied in response to COVID-19.

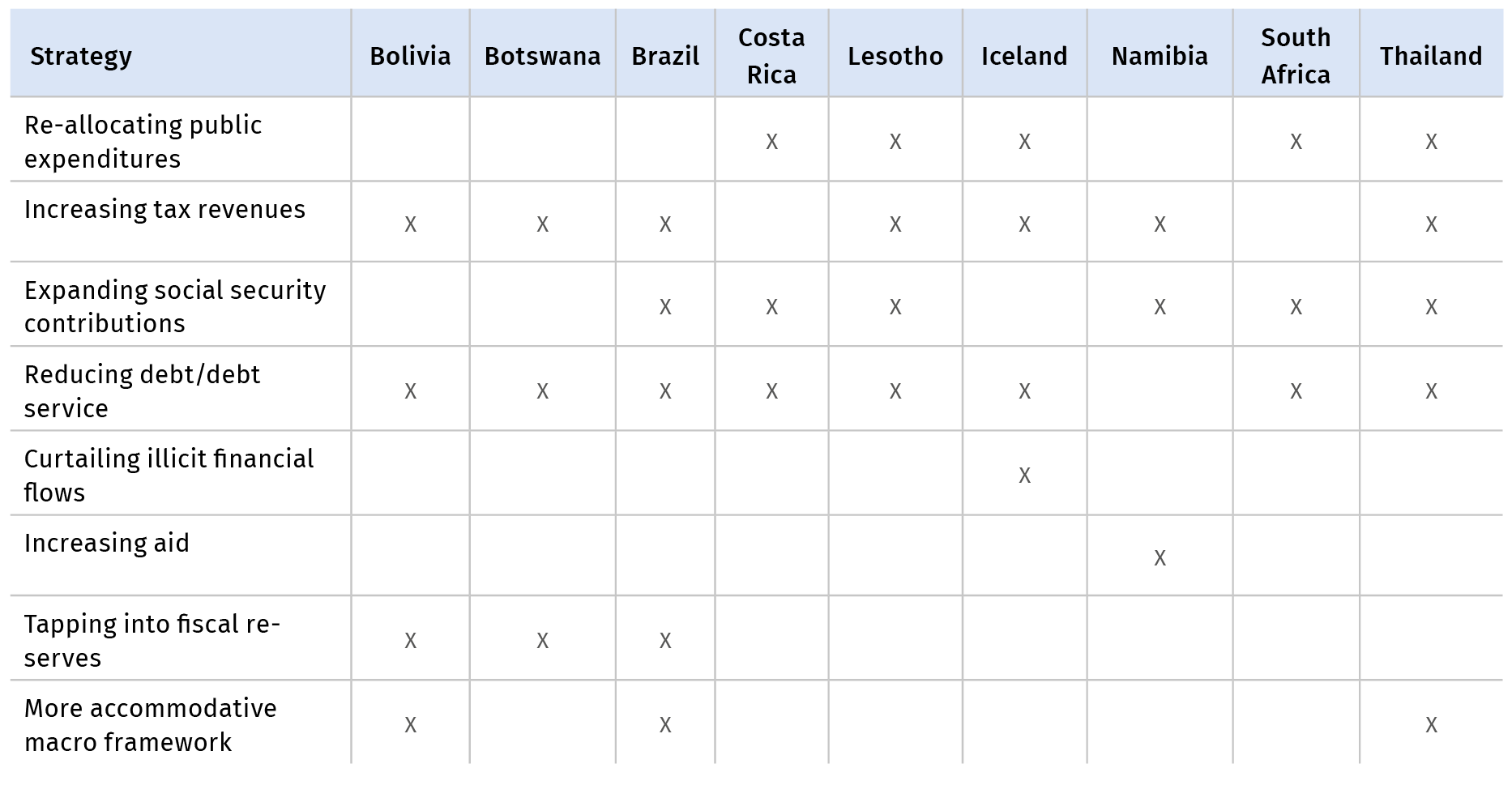

Each country is unique, and all fiscal space options, including the potential risks and trade-offs, should be carefully examined and considered in an inclusive national social dialogue. All countries have at least some of these options. It is important to identify which funding possibilities may or may not be feasible in the short and medium term. In order to enhance transparency, national ownership and political will, the different alternatives and trade-offs must be discussed in an open manner with full stakeholder participation. As reflected in Table 3.1, most countries combine multiple options. Ultimately, successfully creating fiscal space requires understanding the winners and losers of a specific option and effectively debating the pros and cons in an inclusive public national dialogue.

______________________________________________________________________________________

Examples of fiscal space strategies adopted in selected countries

______________________________________________________________________________________

Ortiz, Cummins and Karunanethy, Fiscal Space for Social Protection and the SDGs.

Citizens have challenged and successfully reversed austerity measures over the past decade. For instance, following demonstrations and campaigns, governments have reinstated subsidies (Bolivia in 2010, Ecuador in 2019, Nigeria in 2012), reversed tax increases on basic goods (Burkina Faso, Cameroon and Ivory Coast in 2008), and reversed water fee increases (Ireland in 2016) and higher student fees (South Africa in 2016).[6] Regarding pension and social security reforms, courts in Latvia (2010), Romania (2010) and Portugal (2013) declared austerity cuts unlawful and unconstitutional and forced social benefits to be reinstated.[7]

Here are five steps to prevent austerity and foster a robust socio-economic recovery:

| Step 1. | Identify whether or not your government is cutting public expenditures. Check Ortiz and Cummins (2021), OXFAM (2021) and particularly the IMF website.[8] |

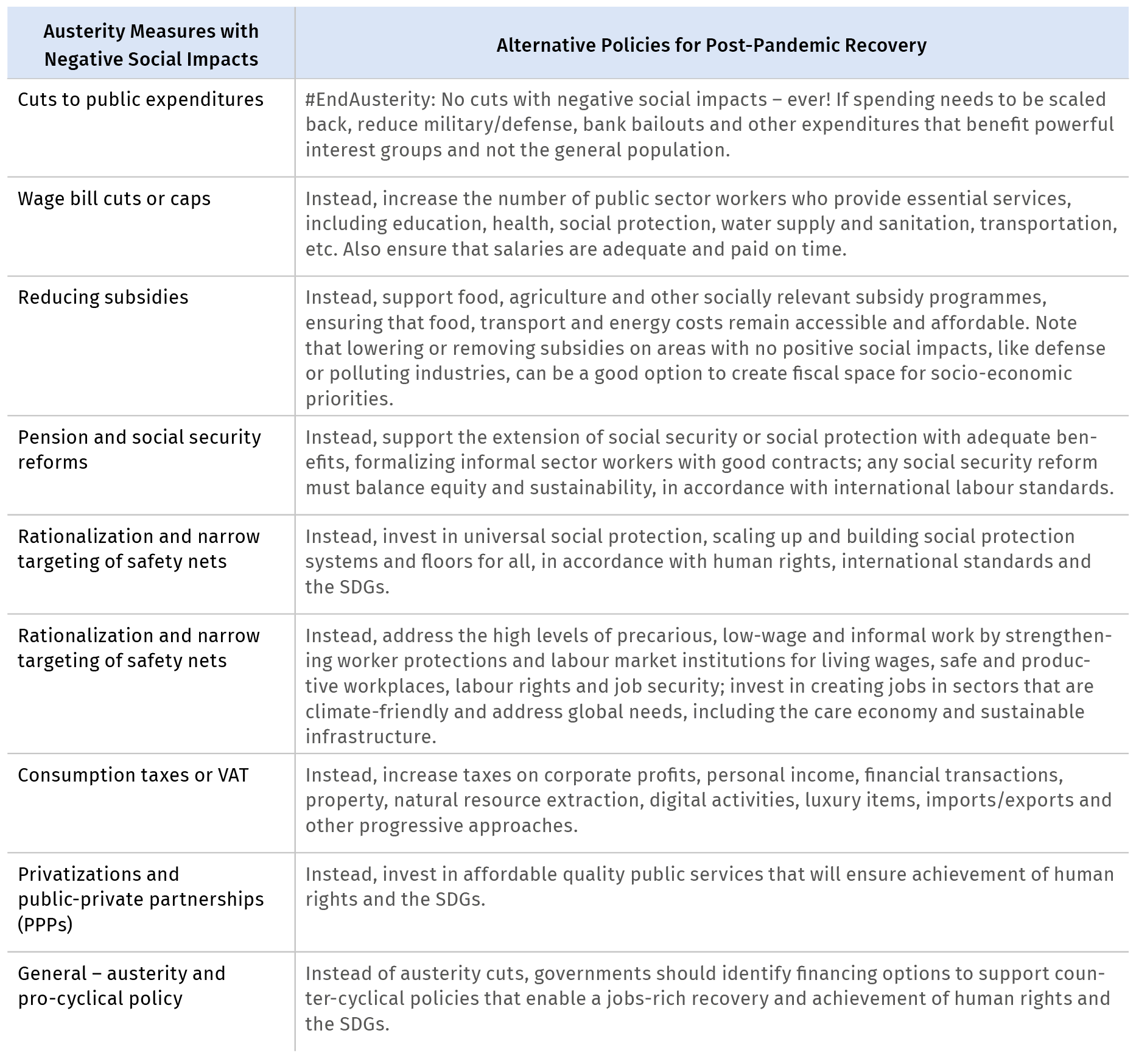

| Step 2. | State alternative demands for post-pandemic recovery. Any austerity measure that results in negative social impacts should be avoided and countered with an alternative policy (see examples in Table 2). |

| Step 3. | Call for national social dialogue. Policy and financing decisions that affect the lives of millions of people cannot be taken behind closed doors at the Ministry of Finance. National tripartite dialogue, with government, employers and workers as well as representative civil society organizations, Parliaments, United Nations agencies and others, is fundamental to generate the political will to exploit all possible fiscal space options in a country, and adopt the optimal mix in terms of macroeconomic and fiscal policy, the need for job and income security and human rights. |

| Step 4. | Carry out a rapid and timely assessment of the social impacts of the different policy options and financing alternatives. This should not be a long and technically difficult document, but rather a quick scoping exercise that enables meaningful national debate. |

| Step 5. | Agree on an optimal set of policies through national social dialogue with representative trade unions, employers, CSOs and other relevant stakeholders. |

Common austerity measures and alternative policies for post-pandemic recovery

[1] IMF, World Economic Outlook, October 2020: A Long and Difficult Ascent, 2020.

[2] I. Ortiz and M. Cummins, Global Austerity Alert: Looming budget cuts in 2021-25 and alternative pathways, IPD Global Social Justice, International Trade Union Confederation, Public Services International, Arab Watch Network, Bretton Woods Project and Third World Network, 2021.

[3] https://www.brettonwoodsproject.org/wp-content/uploads/2020/10/statement-against-IMF-austerity-English-2.pdf.

[4] OXFAM, “The Inequality Virus: Bringing together a world torn apart by coronavirus through a fair, just and sustainable economy,” 2021.

[5] I. Ortiz, M. Cummins and K. Karunanethy, Fiscal Space for Social Protection and the SDGs: Options to Expand Social Investments in 187 Countries, ILO, UNICEF and UN Women, 2017.

[6] I. Ortiz, S. Burke, M. Berrada and H. Cortes-Saenz, World Protests 2006-2013, IPD and Friedrich-Ebert-Stiftung, 2013.

[7] ILO, World Social Protection Report 2017-19: Universal social protection to achieve the SDGs, 2017.

[8] Find your country on the IMF website (https://www.imf.org/en/Countries); see Annex with country data in Ortiz and Cummins, Global Austerity Alert; and OXFAM, Behind the Numbers: A dataset on spending, accountability, and recovery measures included in IMF COVID-19 loans, 2021.