By Matti Kohonen, Financial Transparency Coalition

In April 2021 the Financial Transparency Coalition (FTC) issued a report that tracked fiscal and social protection recovery measures in nine countries in the global South (Bangladesh, El Salvador, Guatemala, Honduras, India, Kenya, Nepal, Sierra Leone, South Africa).[1] This People’s Recovery report showed that on average in the year 2020, these countries in the global South provided stimulus measures equivalent to only 3.9 percent of their GDPs. This falls below the 10 percent of GDP threshold called for by UN Secretary-General António Guterres in March 2020.[2] Funds directed toward social protection totalled approximately 1 percent of their GDPs, while such funds should have made up most of the committed funds if a rights-based frameworks had been used.

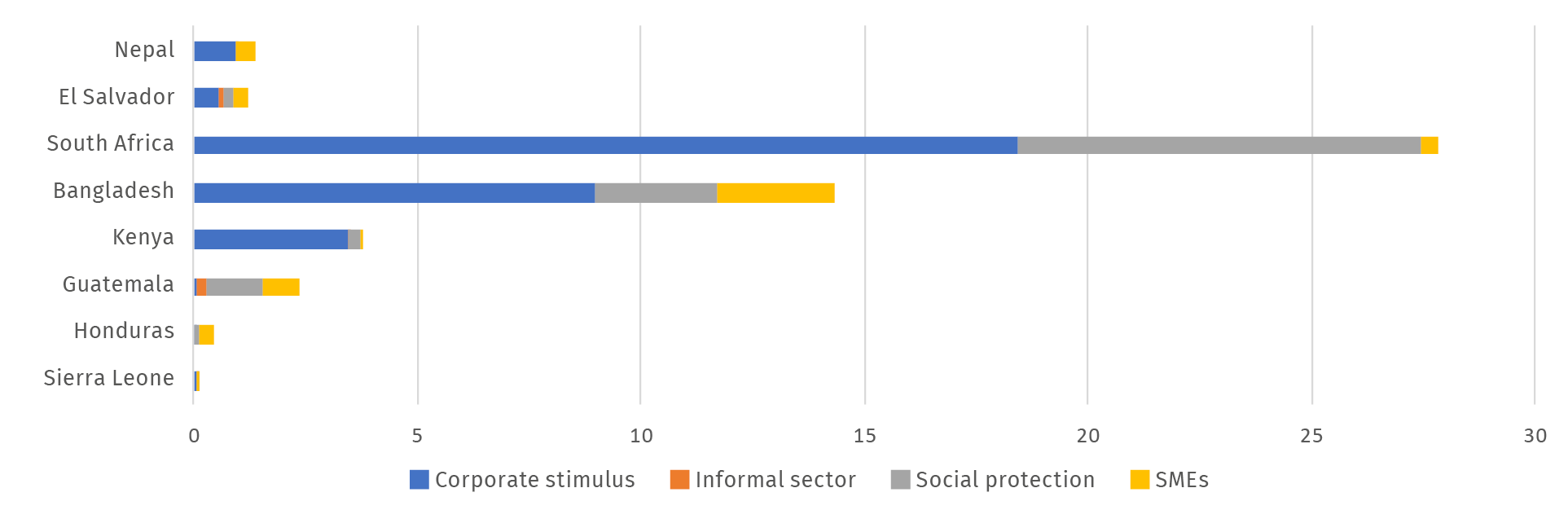

A total of 63 percent of announced COVID-19 funds in eight of the nine countries (excluding India due to data issues), which totalled US$ 51.4 billion, went to large corporations, rather than small and medium enterprises (SMEs), informal sector enterprises or social protection measures (see Figures 1.6 and 1.7). Most of this total was in the form of loans given to the corporate sector as part of recovery plans, and some of these loans were made because the International Financial Institutions (IFIs) laid a heavy preference on private sector funding during the crisis for their earmarked concessional lending, covering energy, roadbuilding and export sector needs. The figure of corporate recovery spending also includes tax cuts, tax exemptions and tax amnesty programmes benefiting the corporate sector. These were only costed in Kenya, where a hefty corporate tax cut was given, in all other countries tax measures are hidden from sight.

Figure 1.6: COVID-19 recovery spending in selected countries in 2020

(in US$ bn)

Source: authors’ calculations, People’s Recovery Report 2021.

Questions were raised in South Africa, Guatemala and Bangladesh concerning unspent Micro, Small and Medium Enterprise (MSME) loans, which were a big part of the discrepancy between the actual and implemented recovery spending. This is likely to be due to the State asking commercial banks, with which MSMEs do not bank, to implement the disbursing of loans. In India, the loan criteria were extended to include larger companies up to US$ 33 million in turnover (previously US$ 13 million in turnover), and thus MSME and corporate support can’t be distinguished in India.

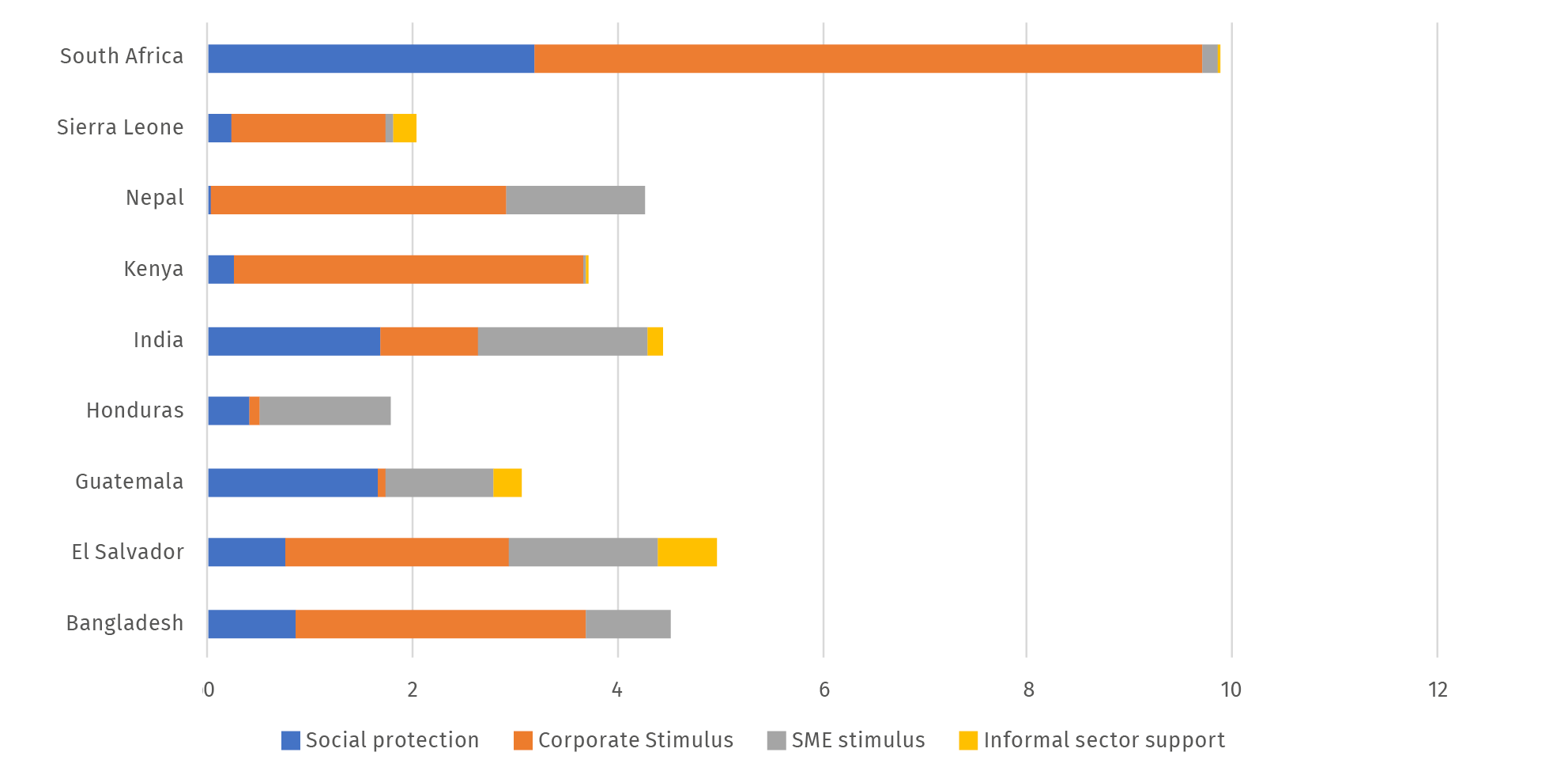

Figure 1.7: COVID-19 recovery spending in selected countries in 2020

(as % of GDP)

Source: authors’ calculations People’s Recovery Report, 2021.

The FTC COVID-19 People’s Recovery Tracker – a multi-source database which quantifies selected categories of fiscal responses to COVID-19 – found that, on average, just 22.4 percent of the announced recovery spending as a percentage of GDP was in the form of social protection in 2020. Only in Guatemala was social protection the largest share of funds, at 52 percent, a new social protection system Bono Familia (Family Grant) implemented during the pandemic based on pre-existing social protection systems in terms of three instalments of US$ 129, and a final instalment of $US 32 over a duration of six months reaching 2.6 million recipients.[3] The last scheme was closed in January 2021, despite proposals by civil society to expand and make it permanent by mainly cutting down on unnecessary tax incentives (costing approximately US$ 766 million or almost 1 percent of GDP)[4]. The same story repeats elsewhere: in South Africa, the monthly US$ 24 COVID-19 Social Relief of Distress (SRD) Grant created in May 2020 was terminated in April 2021 after two extensions, having reached 5.7 million eligible recipients by September 2020.[5] Government policy decisions follow the trajectory of crisis support as laid out by both the IMF and the OECD early in the pandemic – that is, to provide temporary relief, but not to reform any structural budget allocations.

Very little of recovery spending tracked was explicitly allocated to address gender inequalities exacerbated by the crisis; only in El Salvador an existing programme called Ciudad Mujer was extended with an allocation of US$ 10 million, while in Bangladesh women-led businesses were given a separate loan window. In Nepal, less than 1 percent went towards social protection measures, mainly in the form of a health insurance scheme for those infected or hospitalized by COVID-19, which was drastically scaled down due to larger than expected uptake. In Sierra Leone, delays in funding for a donor-supported social protection programme meant that it did not commence before the very end of 2020.

Wage subsidy and job retention programmes were commonly used, but mostly in export sectors. It was not certain if all of the funds distributed to businesses reached workers most impacted, and it was reported that companies sometimes created ‘phantom workers’ and pocketed the money. In March 2020, Bangladesh announced a stimulus package of US$ 590 million for the export-oriented garment sector for wage support. In addition, laid-off garment workers received US$ 35 a month for three months. Other sectors did not receive such support, as this was in part funded by a relief programme (worth US$ 134 million) backed by the European Union (EU) and Germany, a major export market for Bangladeshi garments.

The People’s Recovery report calls for keeping in place social protection measures widened in terms of scale and access after the immediate crisis, and for expanding them where they don’t reach universal coverage. Health insurance programmes created during the crisis, such as the scheme in Nepal, could also be built upon to become wider health coverage programmes. Fiscal expansion can be financed by agreeing to a fair deal on a global minimum corporate tax rate of 25 percent (instead of the G7’s unfair proposal of 15 percent where they keep the revenue mainly to themselves).

Also, illicit financial flows, including tax abuses, could be tackled following the UN FACTI Financial Integrity for Sustainable Development 2021 report’s 14 wide-ranging recommendations.[6] This was done in Nepal where the government opened a capital gains tax dispute in the case of transfer of ownership of a local Coca-Cola bottling company, pursuing a US$ 91 million penalty in unpaid taxes from the old and new owners.[7] This figure is nearly ten times the amount allocated to social protection measures (US$ 10.4 million) during the pandemic.

These kinds of fiscal measures should be pursued alongside claims for debt relief, and the US$ 650 billion new issuance of Special Drawing Rights (SDRs) agreed in August 2021 by the IMF to provide further financing and enable future government fiscal expansion from expanded central bank reserves and channelling of unused SDRS in the global North to the global South towards creating a people’s recovery rather than a corporate led recovery.

[1] https://financialtransparency.org/wp-content/uploads/2021/04/FTC-Tracker-Report-FINAL.pdf

[2] https://www.un.org/en/un-coronavirus-communications-team/launch-report-socio-economic-impacts-covid-19

[3] https://dca.gob.gt/noticias-guatemala-diario-centro-america/plazo-para-retiro-del-bono-familia-venc…

[4] https://icefi.org/sites/default/files/presentacion_-_bono_familia_2021.pdf

[5] https://media.africaportal.org/documents/DPRU_PB_20_55.pdf

[6] https://uploads-ssl.webflow.com/5e0bd9edab846816e263d633/602e91032a209d0601ed4a2c_FACTI_Panel_Report.pdf

[7] https://www.kathmandutribune.com/coca-cola-turns-sour-for-nepalis/